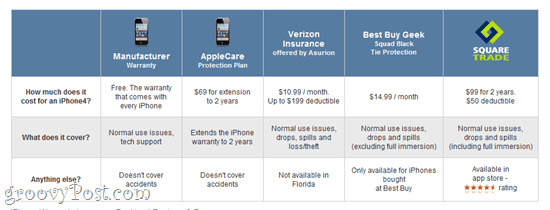

In some of these cases (not including theft or accidental damage), you’ll be in warranty territory. You can usually get your phone, laptop, or peripheral repaired or replaced for free a period of 1 to 3 years after purchase. But when that warranty period expires, you’re on your own unless you buy more coverage via insurance or an extended warranty. Since you’re reading groovyPost, we’re going to assume that you’re savvy enough to know that the extended warranty from Best Buy and the smartphone/iPhone insurance from Verizon or AT&T are exorbitantly overpriced. Verizon’s iPhone insurance plan is about $11 a month. But that doesn’t mean that all extended warranties are a raw deal. Today I’m going to take a look at some of the best value warranties and electronics coverage from third parties and manufacturers to help you be prepared should you have a whoops… with your mobile.

SquareTrade

But is it a good deal? For a new Verizon iPhone 4, you can get two years of coverage for $99. That covers you for drops, water damage (including full immersion), and normal wear-and-tear. When you file a claim, you have to pay a $50 deductible, but that’s far less than the $600 you’d pay to get a replacement iPhone 4 without the new contract subsidy. That breaks down to about $4.12 a month. Not bad. Note: That’s the promotion price in honor of the new Verizon iPhone. It’s 35% off until 2/14. The regular price is $124. After that, try the SquareTrade coupon code “introduction” and get 20% off.

SquareTrade doesn’t just cover iPhones. You can get it for computers, TVs, even a refrigerator. Note that the basic coverage for most items doesn’t include accidental coverage—you have to pay extra for that. Depending on the item, when you file a claim, you either end up shipping the item to your nearest service center or take it to an authorized repair shop (chosen by SquareTrade). Or, if it’s something big, like an air conditioning unit, they’ll send out a guy to provide in-home service. It seems like a pretty good deal to me if you’re a klutz or just nervous about your gadgets staying in one piece.

SquareTrade vs. AppleCare

For those of you wondering about AppleCare vs. SquareTrade, AppleCare is less expensive. You basically get one free year of AppleCare for all new and refurbished iMacs, MacBooks, iPads, iPhones, and iPods. You pay $69 to extend it to two years. The thing I like about AppleCare is you can buy it later, which is what I always do. I wait and see if my computer or iPod Touch breaks within 364 days, and if it doesn’t, I’ll buy it on the anniversary of my purchase. You can’t really do that with SquareTrade—you must purchase warranties within 90-days of your purchase or 30 days if your purchase was made online. The downside of AppleCare is that they provide you less coverage and arguably more hassle. You may like the convenience of popping into a local Apple Store, but if you don’t have one in your town, it’s going to be a pain. They officially don’t cover physical damage or accidental damage either—they only protect you from manufacturer defects. So if your like me and drop your iPhone a few days after you buy it, be prepared to shell out some cash to fix it. That being said, I have come into the Apple Store for minor things—a bent plug, a cosmetic piece of plastic chipping off—and the “Genius” fixed it for free. I remember showing him my bent-beyond-use plug adapter and asking if AppleCare covered it, and he shook his head and said “No,” while simultaneously handing me a brand new one.

Electronics Protection from Your Insurance Company

A few years ago, forum-goers reported excellent iPhone insurance deals via Allstate’s personal articles policy. Essentially, the personal articles policy gives you no deductible and worldwide coverage for anything you’d like—laptops, jewelry, Coach purses, golden sneakers, etc. The annual cost depends on the value and description of the object, but usually, it comes out to about $30 a year. Unfortunately, StateFarm got hip to how clumsy we can be with our phones. Most agents won’t cover smartphones via a personal articles policy. The odd thing about StateFarm is that they don’t have one national line you can call to talk to an agent in a call center. Instead, you talk to a local agent. So, you might be able to get them to cover your iPhone if they didn’t get the memo, but chances are slim. To verify this, I called the office of Monica Bonacci (warning—wacky video pop up on this site), a random StateFarm agent in my area. They told me that they would not cover phones at all. They would cover laptops, and that includes everything: theft, accidental damage, fire, spilled latte, etc. The person I spoke to said that she once busted part of her laptop just by being too rough with it while getting it out of her car, and she successfully filed a claim. The cost, she said, is about $30/year. No deductible. This is a separate policy, and you don’t need homeowner’s or renter’s insurance to get it—though if you had those, your stuff would be covered from theft, fire, flood, etc., by that. I figured it’d just be good due diligence to call another company, so I phoned Nationwide, which does have a big ol’ toll-free number for anyone from anywhere to call. I asked them about any protection for phones and gadgets, and they said that there were none. The agent I spoke with said that your homeowner’s or renter’s insurance policy would already cover some gadgets up to $1,000 and computers up to $3,000. I asked him what would happen if he accidentally broke it, and he said that would be a warranty issue and wouldn’t be covered. I asked him if it would only be covered by theft or if it would also be covered if you lost it or left it at the bus station, and he hesitated. “Well, there’s something called ‘mysterious loss’ that you might be able to file a claim for….” He sounded sketchy on the prospect, so my take is that mysterious loss is more of a way of filing something into the system where there’s no tidy explanation. At any rate, I wouldn’t count on using it to protect you from losing your laptop. And don’t even think about trying to say that it was stolen because that, my friend, is fraud. Anyway, bottom-line regarding your insurance company: you can get cheap protection for your computer with a personal article’s policy, but you’re out of luck with your phone. Editors Note: I’ve had a StateFarm Personal Articles Policy for about 5 years and… I love it. It covers all my computer equipment and my wife’s high-end camera gear, including her Lenses, Camera Body, and Small Point-and-Shoot cameras. We paid about $35 a year and were covered from Loss, damage, and theft. About 12 months ago, we were in a boat, and I dropped my camera in the lake, and with no questions asked, I had a check for a replacement about 7 days later. No questions asked. That being said, yeah… mobile phones are not covered.

Warranty or Insurance?

SquareTrade and AppleCare are warranty products, while Verizon’s iPhone insurance and Allstate’s personal articles policy are insurance. The main difference here is what’s covered. Insurance protects you when something goes wrong, regardless of who’s at fault. Warranties typically only cover you if the manufacturer messed up, except SquareTrade, which also offers accidental damage protection. Warranties also do not cover theft, whereas Verizon, Allstate, and StateFarm do.

Credit Card Protections

The glory days of credit card perks are on their way out, thanks to the federal government clamping down on the extortion practices on low-income, bad credit individuals that subsidized much of the perks premium members received. But if you have a decent Discover, Visa, Mastercard, or American Express card—such as a platinum or gold card—you’ll often have Purchase Protection and Extended Warranty coverage built-in. For non-premium members, you can add on Purchase Protection for a small fee. So, how does it work? While terms vary from card to card, usually Price Protection means that anything you buy using your credit card is protected from loss, theft, or damage for u to 90 days after purchase. That means anything. If you buy a Faberge egg while on vacation in Europe and the maid steals it out of your hotel safe, that’s covered. If you buy your kid an iPod Touch and he drops it in the toilet, it’s covered. If you unbox your new iPhone and then drop it on the floor while trying to slide it into your pocket, it’s covered. Just file a claim, and your credit card company will reimburse you. After the 90 days are up, you’ll be covered by the manufacturer’s warranty. But once your free manufacturer’s warranty is expired, your Extended Warranty feature on your card will usually double it. That means that if you have a 1-year warranty on your new laptop, your credit card company will pick up the coverage for an additional 1-year afterward. Usually, the credit card company will cover the cost of repairs if it breaks due to a manufacturing defect. That would be something like a hard drive failure or the compressor on your fridge going out, not a hairline crack on your iPad from dropping it onto the pavement. I’m not speaking from experience, but I imagine they’d try their best not to replace it if a repair were at all possible, but I’m sure it’s not impossible to get a new one. If you want to take advantage of your credit card’s built-in features, do the following:

Double-check that you have this coverage. The best way is to call your credit card company and ask, but oftentimes you can register online, and the system will tell you if you have it or not. For example, Visa’s claims portal is located here.Pay for your laptop, iPhone, or appliance with your credit card in full. For example, you can’t pay for a $1,000 laptop with $999 in cash and then put the last $1 on your card and get protected.Keep your receipt, including your credit card receipt.Find the manufacturer’s warranty and keep it.Register your product online or by calling your credit card company. Do this right when you purchase it. It’s not always necessary, but it’ll make things go more smoothly if you need to file a claim two years later.Don’t cancel your credit card. The card must still be active to get coverage.

Conclusion

As you can see, you have quite a few options for protecting your iPhone, iPad, laptop, or other electronic gadgets. The best of all of these is obviously the manufacturer’s warranty. It’s free, and you don’t have to do anything to get it. The next best is probably your credit card’s protection plan if you have a credit card and use it for the purchase. After that, I’d be split between a homeowners/personal articles insurance policy and SquareTrade. Personally, I prefer to let my home insurance cover my stuff since I rarely leave the house. But if you spend most of your days in airports and coffee shops, SquareTrade would probably be best for you. The last choice I’d probably choose is Best Buy or an extended AppleCare warranty. I know that it’s totally worth it if you do end up getting a repair or replacement for free (Apple charges a $199 out-of-warranty service fee to repair iPhones), but my theory is that if something I own is a lemon, it’ll crap out within the first few months. So being a realist, I always say – “Hope for the best but plan for the worst!” Hopefully, this helps you do the same! Comment Name * Email *

Δ Save my name and email and send me emails as new comments are made to this post.

![]()